Block66 is a mortgage lending platform. They aim to build a blockchain enabled marketplace for mortgages, for institutional and private lenders to offer loans to borrowers, from origination to facilitation. Loans will be transformed in tokens as tradeable securities with the ability to be traded as fractions, reducing the fees to make it an attractive investment vehicle. This way different problems, such as the need for bank account, geographical lending restrictions and counterparty risks, are overcomed. On the platform the lenders can access a marketplace of vetted borrowers looking for mortgage finance. Everything is public, transparent and highly automated. Each loan is using a pool of Proof of Loan (PoL) tokens that can be individually resold to provide lenders with liquidity. Each loan has his own smart contract, doing its own minting and selling and tracking the ownership of their PoL tokens. Block66 will run on the Ethereum network and it will be implemented as and decentralized App.

Who are the users of this platform? First of all, the borrowers, looking for better mortgage offers, then the brokers, searching for bigger pipelines to make up for the compressed margins, private investors looking to reduce exposure and lower the risks and institutional investors also, to address some of the risks exposed by the latest 2008 financial market crisis. Then we will have the solicitors, because once the borrower and lender(s) have been matched, we need professionals to check what conditions need to be satisfied before the application can progress. Underwriters also, as a group of Block66 vetted professionals, will be present, and their fees will be paid by either the broker or the borrower.

According to the White Paper, there will be two phases, first, in the Phase I, they will have a matching engine for borrowers and lenders, with an advantageous three fold saving on conventional mortgage application times, and all loans will be on the blockchain, with funds used via Smart contracts. In the Phase II a platform of choice for lenders will be created, in order to make tokenized mortgage-based securities on the blockchain. This will have as a result a platform that matches private and institutional lenders with borrowers and make a secure mortgage loan agreement. First will be tested in US and Canada, and later will be implemented globally.

The Block66 token (B66) is used to produce Block66 network tokens (BNET). The Block66 network tokens are used to pay for services on the Block66 network and they are ERC20 compatible. PoL tokens (Proof of Loan) are generated once a mortgage is fulfilled . All the network fees are to be paid exclusively in BNET tokens. This part sounds a bit complicated, so we have three types of token. Let’s find out more!

Block66 Token symbol: B66

Hard Cap: 12.285.000.000 USD

Platform: ERC20

Token supply: 300 millions

Circulating supply: 135 millions

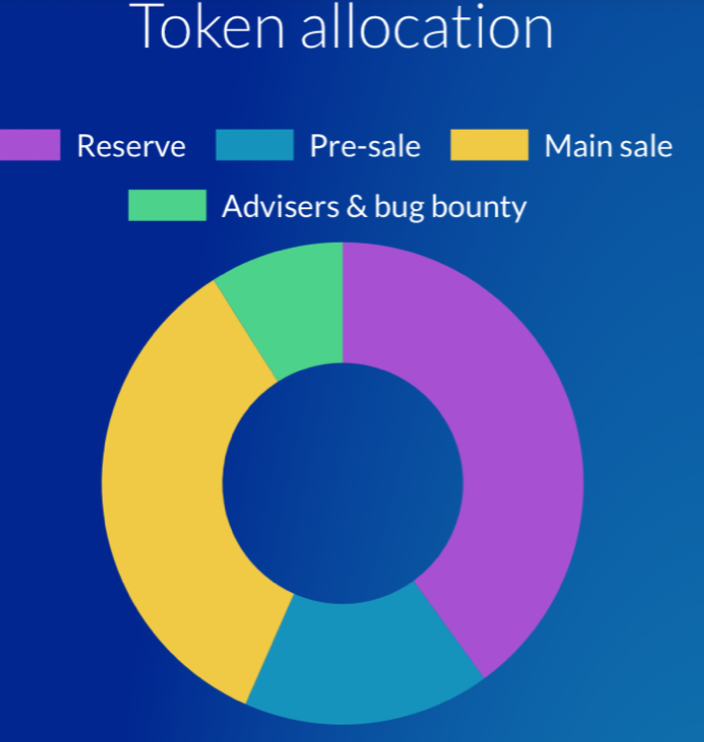

Tokens breakdown:

- 46% (138 millions)held by Block66

- 10% (27 millions) for team, advisers and bounty

- 44% for sale out of which 40.5 millions for pre-sale with 33% discount at 0.07 USD and 94.5 millions for crowd-sale at 0.10 USD.

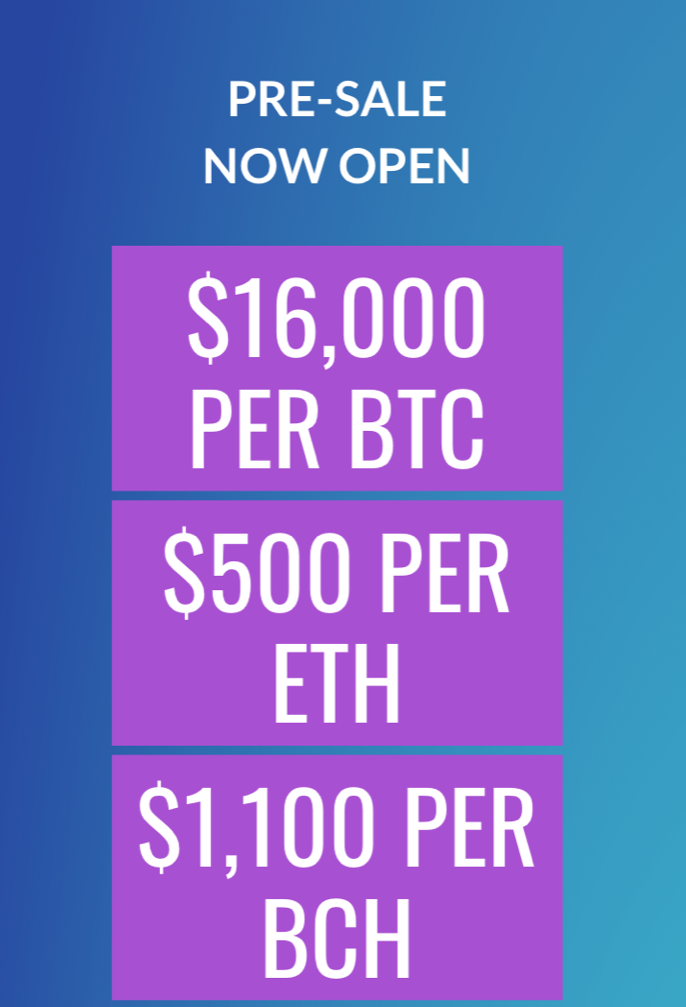

The token pre-sale will start at 6.9.18 and the end date is to be discussed. The minimum amount for the bonus is 500 USD. The supported cryptocurrencies are: Bitcoin (BTC), Ethereum (ETH) and BitcoinCash (BCH) and the value for each currency can be seen in the next tab.

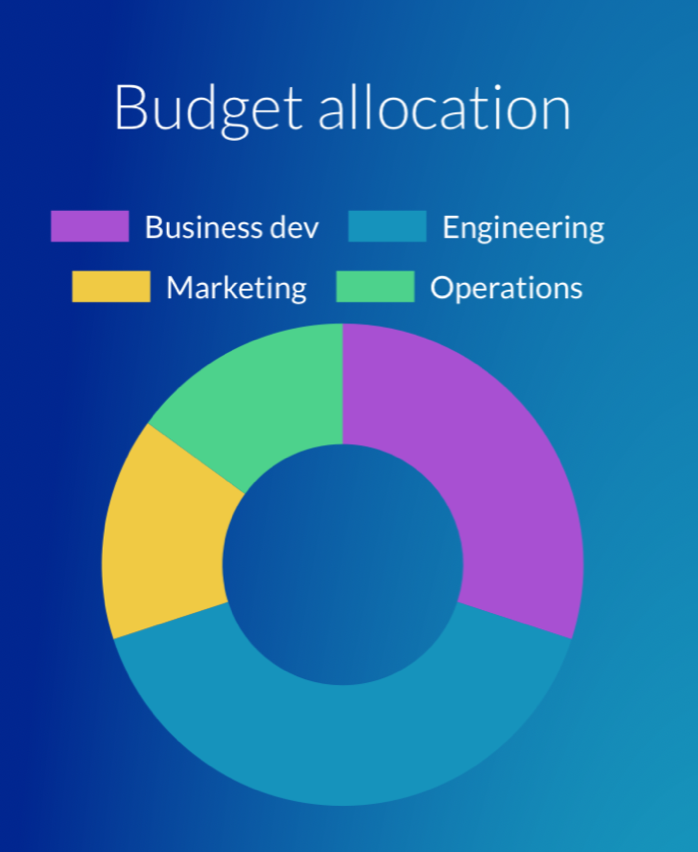

The budget allocation is as following:

- 30% business development

- 40% engineering

- 15% marketing

- 15% operations.

Now we will take a look at the Road Map. Everything started in the first quarter of 2017 with the inception of the project, White Paper draft and the contact with the early advisers and initial team members. Next steps where:

- Q4 2017 -User journey and matching engine operating flow was designed;

- Q2 2018 -Token generation event, the office was built out, wireframing and prototypes for the platform were produced;

- Q3 2018 -Design and distribution phase. The Block66 Alliance of customers was created. Product was planned and designed.

- Q4 2018 -Build phase. The Alpha testing was done with the help of the first customer users on the platform. Block66 Alliance first report.

- Q1 2019 -Release of the Phase I, MVP launch, first batch of on the chain loans funded and distributed via network.

- Q3 2019 -Release of the Phase II, loan tokenization available, network users can trade on-chain securities of a fractional basis, with smart contracts ensuring that loan repayments are distributed to all token holders.

The project seems solid, the White Paper is self explanatory and you can always check the website for more informations. As a person who went through the experience of trying to get an mortgage, i can only say that i welcome this kind of application on the blockchain.

(Disclaimer: This article was created in exchange for a potential token reward through BountyOx. BountyOx username: Heruvim78)

No comments:

Post a Comment